santa clara property tax appeal

If you disagree with the. Property Tax Cancellation of Penalty Requests.

Bay Area Real Estate Recovery Creates Property Tax Appeal Opportunities

Send a Message Call.

. Louisiana is ranked 1929th of the 3143 counties in the United States in order of the median amount of property taxes collected. Currently you may research and print assessment information for individual parcels free of charge. Jefferson Parish collects on average 043 of a propertys assessed fair market value as property tax.

So if your property is assessed at 300000 and your local government sets your tax rate at 25 your annual tax bill will be 7500. It provides property tax relief by preventing the reassessment change in base year value of real property when it is transferred between parents and children. The median property tax in Virginia is 186200 per year for a home worth the median value of 25260000.

The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100. 59-2-1035 for property in this state that is the primary residence of the property owner or the property owners spouse that claim of a. PROPERTY TAX POSTPONEMENT PROGRAM.

PROPERTY ASSESSMENT INFORMATION SYSTEM. Application for Residential Exemption or Request a paper application via. Virginia is ranked number twenty one out of the fifty states in order of the average amount of property taxes collected.

Or struggling with mental illness substance use or both. This program gives seniors 62 or older blind or disabled citizens the option of having the state pay all or part of the property taxes on their residence until the individual moves sells the property dies or the title is passed to an ineligible person. This list is subject to change.

The Behavioral Health Call Center is the entry point for access to all Santa Clara County behavioral health services. A taxpayer may request cancellation of any penalty assessed on a secured or unsecured property tax bill by completing and submitting a Penalty Cancellation FormThe signed and completed request form and all supporting documentation are required for consideration of this cancellation request. The Assessor has developed an on line tool to look up basic information such as assessed value and assessors parcel number APN for real property in Santa Clara County.

435 634-5703 If a property owner or a property owners spouse claims a residential exemption under Utah Code Ann. Counties in Virginia collect an average of 074 of a propertys assesed fair market value as property tax per year. Within the Agency Labor RelationsLR administers and enforces labor agreements trains supervisors and managers oversees the meet and confer process monitors usage of temporary employees and represents the County in disciplinary appeal hearings grievances and.

We provide support for individuals and families who are in crisis. Those counties accepting Proposition 90 are Alameda San Diego Santa Clara Los Angeles Orange San Mateo and Ventura.

Commercial Property Tax Shannon Snyder Cpas

Forms Publications And Brochures Office Of The Clerk Of The Board Of Supervisors County Of Santa Clara

Tax Appeal Shannon Snyder Cpas

Understanding California S Property Taxes

Santa Clara County Property Tax Tax Assessor And Collector

Santa Clara County Ca Property Tax Search And Records Propertyshark

Letter How Homeowners Can Appeal Property Assessments The Mercury News

Property Tax Assessment Appeals Exemptions Online Application Template Ast

Secured Property Taxes Treasurer Tax Collector

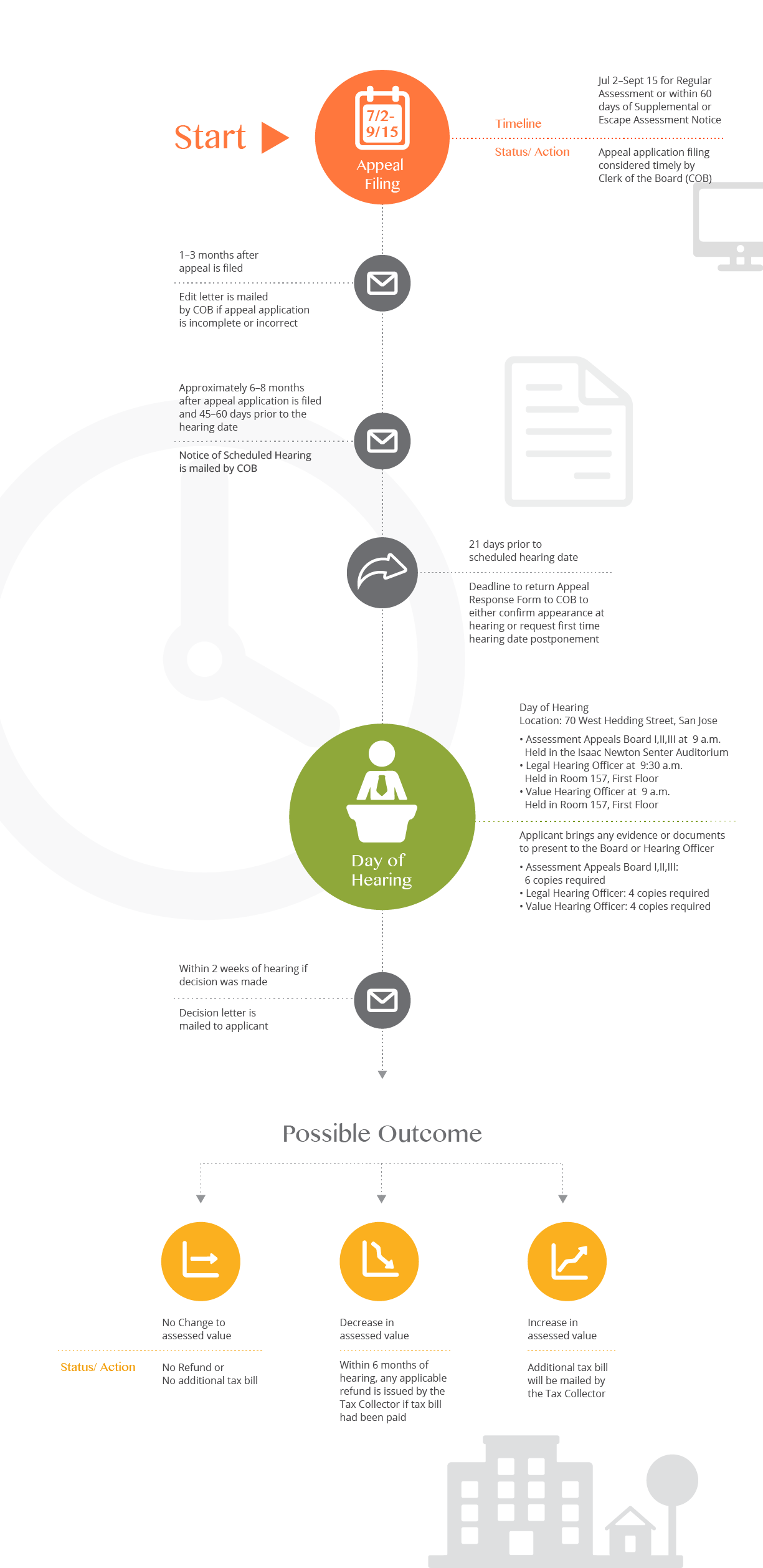

Assessment Appeals Office Of The Clerk Of The Board Of Supervisors County Of Santa Clara

Assessment Appeals Office Of The Clerk Of The Board Of Supervisors County Of Santa Clara

Property Tax Appeal Deadlines Admiral Consulting

Industry News Invoke Tax Partners

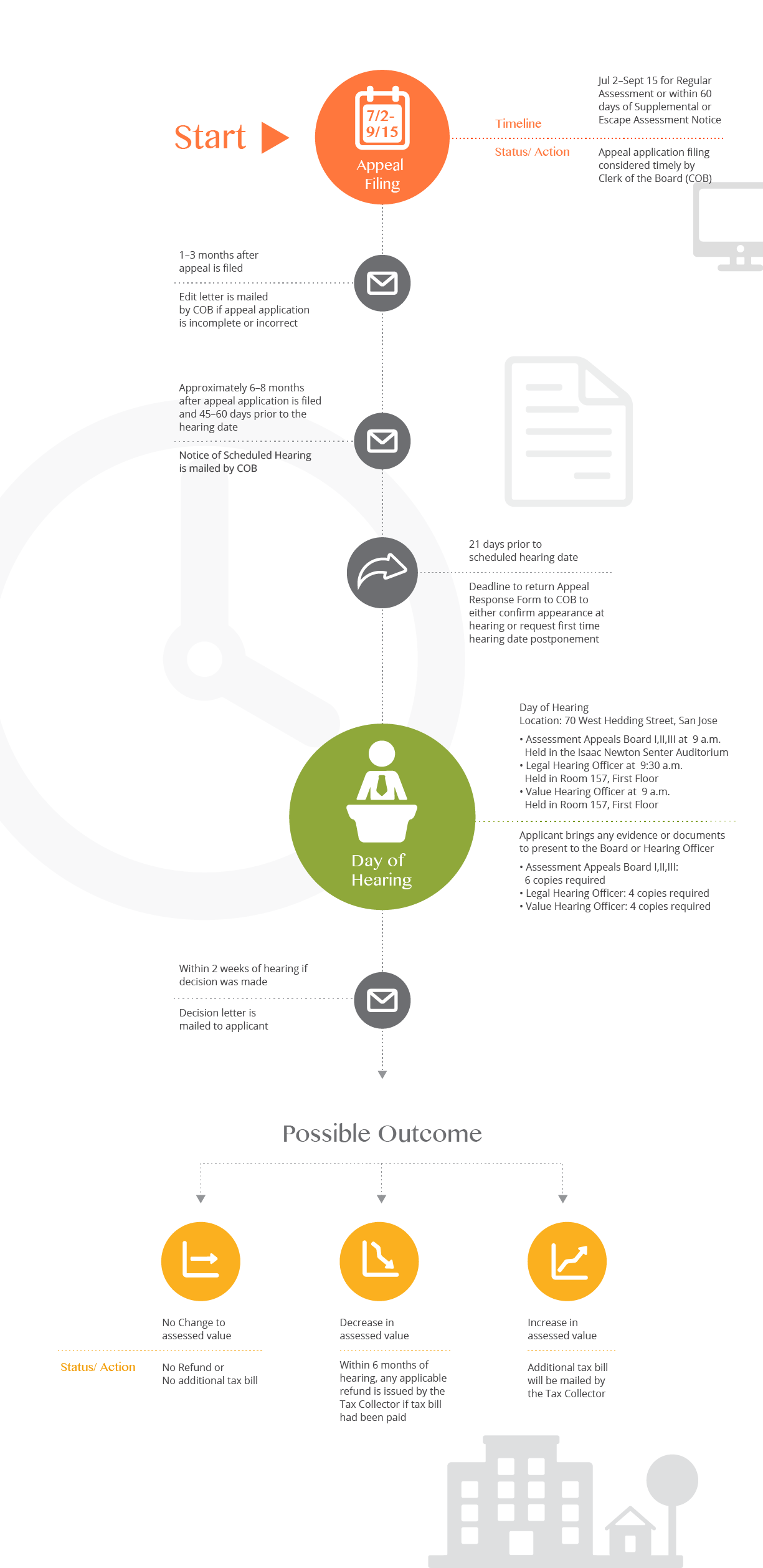

Assessment Appeal Process Office Of The Clerk Of The Board Of Supervisors County Of Santa Clara

Santa Clara Shannon Snyder Cpas

San Jose Tax Appeal Attorney San Francisco Tax Lawyer Offer In Compromise